This post may contain affiliate links and Corporette? may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

I’ve always been passionate about the concept of sinking funds, which allows individuals to effectively amortize specific expenses by setting aside a certain amount of money each month. This strategy, often referred to as targeted savings, involves creating a dedicated fund for anticipated expenses, making it easier to manage larger costs when they arise. I’m curious to hear from my readers: do you utilize sinking funds? What categories have you established to categorize your savings?

Previously, we’ve discussed a comprehensive financial roadmap to guide you through your personal finance journey, including strategies for automating savings and establishing systematic investing. Additionally, we’ve covered the importance of maintaining an emergency fund and the various places to allocate cash when you’re uncertain about your specific savings targets, such as for retirement, weddings, or purchasing a home. Each of these topics plays a crucial role in achieving financial stability.

Some of the more specific challenges we’ve tackled include navigating the financial aspects of divorce, strategies to manage overwhelming student loan debt, and tailored financial advice for new lawyers and individuals starting their careers in high-paying roles. Each of these discussions highlights the importance of being proactive about your financial future.

Understanding the Concept of a Sinking Fund

A sinking fund is essentially a method of saving that is aimed at covering large, irregular expenses that you anticipate in the near future. Unlike a regular savings account or an emergency fund, which serves as a financial cushion, a sinking fund is explicitly designated for specific expenditures, making it a strategic approach to financial planning. This distinction helps individuals prepare for upcoming costs without derailing their overall financial goals.

Evaluating the Need to Invest Your Sinking Fund

When considering whether to invest your sinking fund, it’s important to note that many of the expenses associated with this fund are typically imminent. As such, investing in volatile assets like stocks or index funds may not be prudent, given the short timeline. However, if you find yourself uncertain about your savings goals?such as whether you’re saving for a wedding, a home, or graduate school?consider investing that money for potential growth, taking care to automate the process if possible.

It’s crucial to avoid using retirement accounts for these purposes unless you have a Roth IRA and your savings timeline exceeds five years. This is because, with a Roth, you can withdraw your contributions without penalty after five years, thus offering a bit more flexibility in your savings strategy.

The Importance of Establishing a Sinking Fund

Reducing Financial Stress from Large Expenses

My enthusiasm for sinking funds stems from their ability to alleviate the stress associated with large bills. Unexpected expenses can be daunting, even when anticipated. For my husband and me, our journey into the world of sinking funds began with our term life insurance. We established the policies when our youngest child was born, but a year later, we received significant bills for both policies. The initial payment was surprisingly painful, primarily because we realized we were overinsured, which we later adjusted.

In response, I decided to create a dedicated account to save for this annual expense. My approach involved calculating the total premiums and dividing that amount by 12, making it much more manageable. As I expanded my thinking, I began to include all our insurance premiums and set up automatic transfers to a high-yield savings account. This proactive measure led to the creation of my very first sinking fund.

Maximizing Interest Earnings on Your Sinking Fund

Another significant advantage of sinking funds is the potential for earning interest while the money is set aside. By opting for a high-yield savings account or a short-term certificate of deposit (CD), you can earn a better interest rate than what typical savings accounts offer. This contrasts sharply with the high-interest rates charged by credit cards if you were to finance those expenses instead.

Creating Clear Boundaries Between Accounts

While I could have easily drawn from our emergency fund to cover these expenses and replaced the funds with automatic transfers, I prefer to keep my emergency fund untouched. The psychological barrier against using that fund is strong for me. Conversely, when it’s time to pay our insurance bills, I feel completely justified in using the funds from my sinking fund. Every time I do this, rather than feeling guilty about spending, I experience a sense of relief, knowing that I?ve planned ahead. It feels like a thoughtful gift to my future self.

Exploring My Specific Sinking Fund Categories

Once you grasp the concept, setting up sinking funds becomes straightforward, especially with high-yield savings accounts that allow for multiple ?buckets? or separate accounts. I?ve been using Ally for years for this purpose, although there are numerous options available. Here are some of the specific categories I’ve established over the years:

- Insurance (general)

- Health ? I try to save enough to cover our deductible to manage unexpected healthcare costs better. Recently, I initiated a monthly contribution to our health savings account.

- Home Improvement Projects ? Whether it?s a significant renovation or a minor upgrade, I set aside small amounts each month. For example, currently, I save $20 monthly, which provides peace of mind when spontaneous home projects arise.

- Retirement Contributions ? Each month, we allocate funds for my husband’s Roth IRA, as per our accountant’s recommendation.

- Family Vacation Savings ? As a family of four, vacations can be costly. I assess potential vacation expenses and schedule automatic transfers to ensure we can enjoy our trips without financial strain.

- Expenses for Children ? Although we currently don?t have specific sinking funds for the kids, in the past, I?ve saved for expensive classes or tuition payments to spread the costs evenly throughout the year.

- For my business, I maintain sinking funds for taxes, retirement contributions, continuing education, contractors, legal, and accounting fees.

While not a traditional sinking fund, I also maintain a separate ?Griffin Fun Money? fund distinct from our emergency savings.

Step-by-Step Guide to Establishing a Sinking Fund

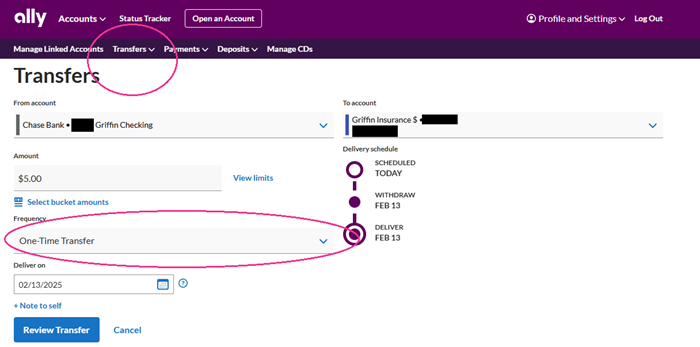

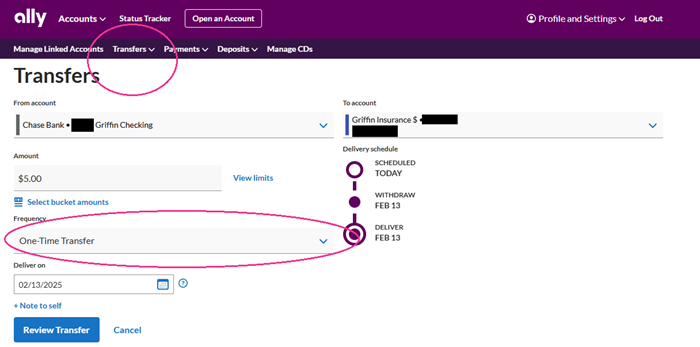

Setting up a sinking fund varies by bank, but generally, you will look for a ?Transfers? section where you can establish repeating transfers. For instance, in Ally, I can easily set up transfers from my daily banking account at Chase to my Ally account.

When configuring the transfer, I have the option to select the frequency, such as biweekly or a specific day of the month, or even a repeating day like the first or last business day of each month. You can also define an end date for the transfers to cease.

To manage multiple automated transfers effectively, it?s advisable to maintain a record that outlines the amounts being transferred and their respective schedules so you can stay organized!

Stock photo via Pexels / maitree rimthong.